Mumbai: K J Somaiya Institute of Management (KJSIM) recently hosted Investrix 2026, a flagship investment forum focused on evolving strategies and emerging trends in capital markets.

Established in 1991 by alumni Madhusudan Kela, Investrix has grown into a prominent platform for discussions around investing, portfolio management, and long-term wealth creation.

The theme for Investrix 2026, “When Money Moves Faster than Cycles: Rethinking Portfolio Diversification,” underscored the shifting dynamics shaping global investment approaches.

Designed to encourage meaningful dialogue between industry professionals, students, and early-career participants, Investrix 2026 aimed to bridge the gap between academic theory and real-world investment practice.

Also Read: India Rises as a Top Investment Choice Amid Global Headwinds: PwC Global CEO Survey

The forum featured a panel discussion, a fireside chat, and a one-on-one interview, each addressing key issues such as portfolio diversification, market volatility, investor behaviour, and strategies for sustainable wealth creation.

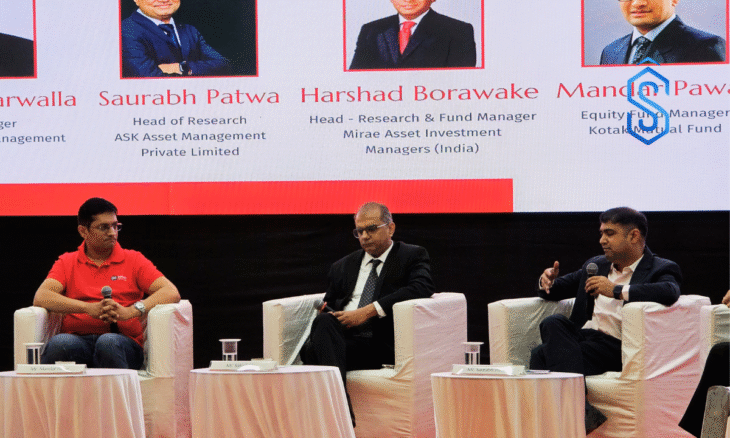

The panel discussion at Investrix 2026 was moderated by Nigel D’Souza, Senior Editor – Editorial and Production at CNBC 18.

The panel comprised Harshad Borawake of Mirae Asset Investment Managers, Ashwani Agarwalla of Edelweiss Asset Management Limited, Saurabh Patwa from ASK Investment Managers, Rakesh Vyas of Quest Investment Advisors, and Mandar Pawar from Kotak Mutual Fund.

Panelists examined the challenges of conventional diversification models, particularly during market stress periods when asset correlations tend to rise.

Investrix 2026 Panel Highlights Limitations of Traditional Diversification

During the fireside chat, Ajay Bagga and Tushar Bohra shared perspectives on navigating uncertainty in the current investment environment.

Their discussion touched upon the difficulty of forecasting markets, the importance of self-awareness, and the evolving role of assets such as gold, silver, and cash.

The conversation also highlighted the need to focus on fundamentals like quality and governance while maintaining a long-term investment outlook.

In a one-on-one session, Shankar Sharma and Prof. Hitesh Punjabi explored the key drivers influencing market movements and investor outcomes.

They emphasised adaptability, probabilistic thinking, and flexibility as critical traits for managing portfolios in unpredictable market conditions.

Also Read: Lighthouse Learning Group Secures Fresh Investment from KKR and PSP Investments

Commenting on the significance of the forum, Dr Raghukumari P., Professor and Chairperson, Centre of Excellence in Capital Markets, said that Investrix 2026 reinforced the importance of mindset alongside analytical skills in achieving long-term investment success.

She noted that discussions on patience, discipline, and continuous learning reflected KJSIM’s commitment to combining academic rigour with practical market insights to prepare future leaders for the complexities of investment and portfolio management.

Through initiatives such as Investrix 2026, K J Somaiya Institute of Management continues to strengthen engagement between academia and the financial industry, offering students and emerging professionals exposure to both experiential market knowledge and structured academic perspectives.